D) neither the buyer nor the seller will bear the burden of the tax. How does a tax on consumers affect demand?

Inelastic Supply Tax. Therefore when the supply is elastic and demand is inelastic the majority of the burden of tax is on the part of consumers or buyers. The above figure has clearly shown the given case.

lectureppt ch06 From slideshare.net

lectureppt ch06 From slideshare.net

A) buyers will bear most of the burden of the tax. When demand is elastic or supply is inelastic, then the seller bears the major portion of the tax, as depicted in diagrams # 2 and # 3, respectively. What will happen when there is an increase in the excise tax on gasoline?

lectureppt ch06

With a pes of 0.2, it is inelastic because pes is less than one. Therefore price elasticity of supply ( pes) = 6.6/33.3 = 0.2. In this case, an increase in price from £30 to £40 has led to an increase in quantity supplied from 15 to 16. When demand is elastic or supply is inelastic, then the seller bears the major portion of the tax, as depicted in diagrams # 2 and # 3, respectively.

Source: slideserve.com

Source: slideserve.com

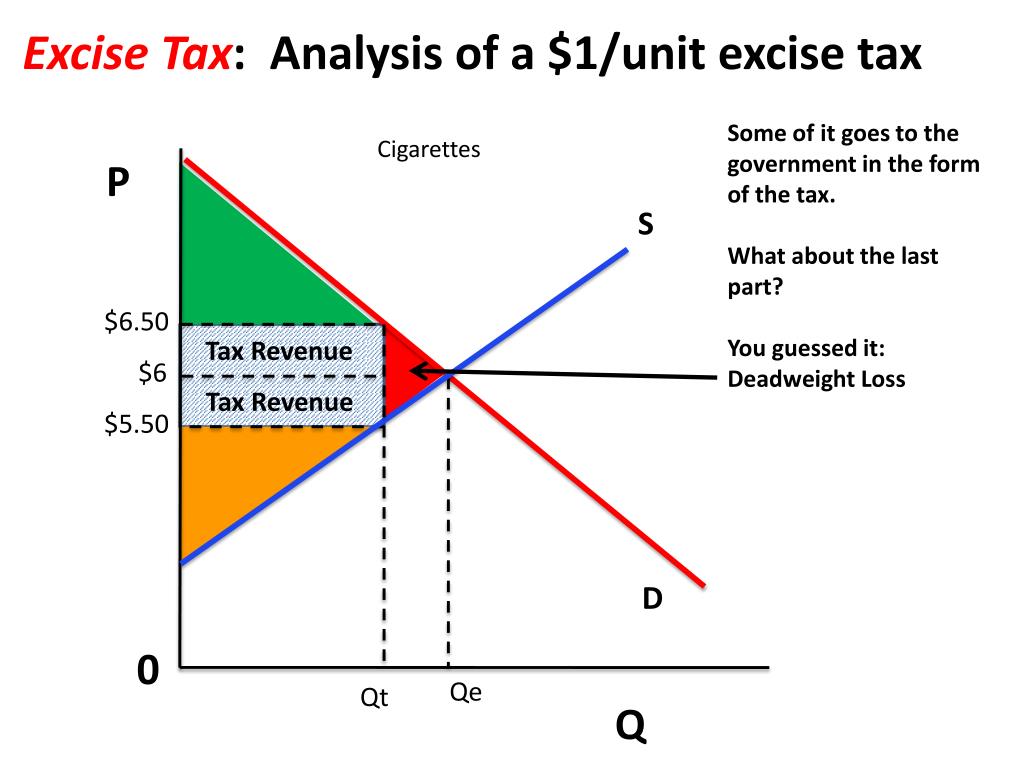

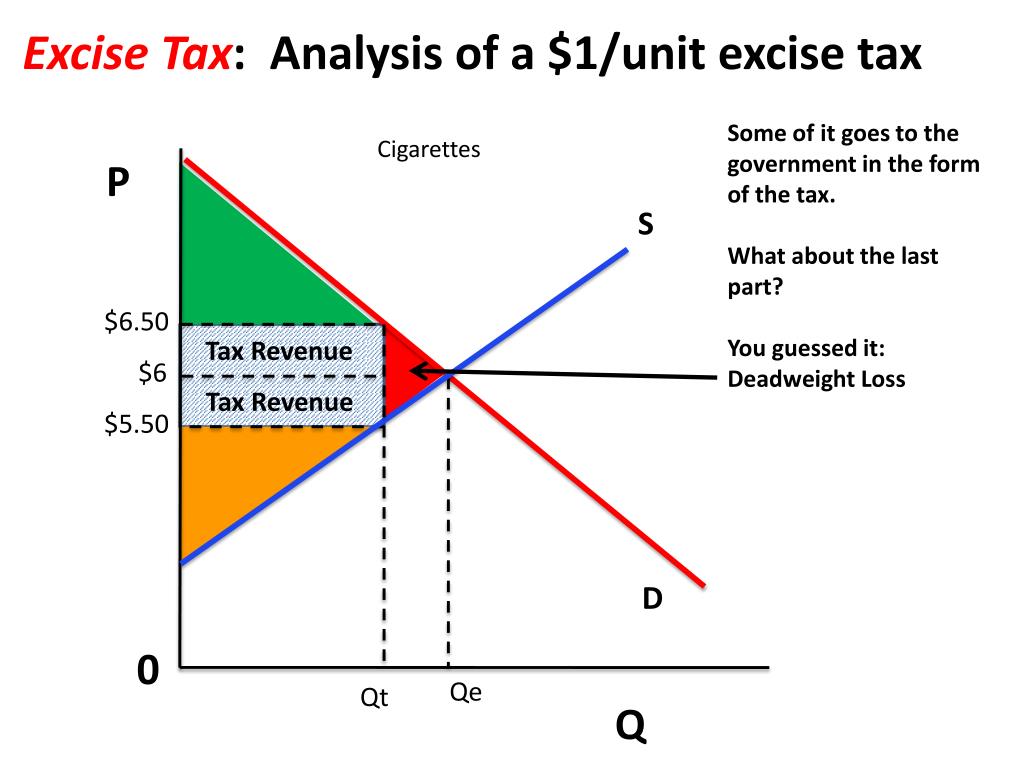

The intuition for this is simple. The imposition of a specific tax of $4 shifts the supply curve vertically by. Buyers if the demand for candy is perfec. Assume that the demand for gasoline is inelastic and that the supply is elastic. Sellers will bear most of the burden of the tax.

Source: slideshare.net

Source: slideshare.net

If the government increases the tax on a good, that shifts the supply curve to the left, the consumer price increases, and sellers’ price decreases. Gets $4 also and the consumer pays $6. If demand is more inelastic than supply, consumers bear most of the tax burden, and if supply is more inelastic than demand, sellers bear most of the.

Source: slideshare.net

Source: slideshare.net

If demand is inelastic, a higher tax will cause only a small fall in demand. Placing a tax on a good, shifts the supply curve to the left. Therefore when the supply is elastic and demand is inelastic the majority of the burden of tax is on the part of consumers or buyers. With a pes of 0.2, it is.

Source: slideshare.net

Source: slideshare.net

Tax incidence with inelastic supply. A perfectly inelastic supply curve means quantity supplied would not change in response to a price change; C) the burden of the tax will be shared equally between buyers and sellers. It means the price paid by the consumers rises substantially and they bear most of the load of the taxation. With a 100 percent.